The QID ETF operates as a intensely leveraged short strategy targeting the leading technology giants. This ETF seeks to amplify the negative performance of the tech titans, providing investors with a way to capitalize from potential market downswings. However, it's crucial to appreciate that the leveraged nature of QID introduces a increased risk profile compared to more traditional portfolios.

- Consequently, it's essential for aspiring investors to fully research the dangers involved before allocating capital to this approach.

Tackling Volatility with QID: Analyzing ProShares UltraShort QQQ ETF Performance

The volatile landscape of the stock market can leave financiers feeling anxious. However, for those seeking to capitalize on market downturns, ProShares UltraShort QQQ ETF (QID) presents a potentially attractive opportunity. This diversified ETF aims to deliver inverse returns of the Nasdaq-100 Index (QQQ), providing a potential hedge during periods of market volatility. Dissecting QID's performance is crucial for investors to make calculated decisions.

- Numerous factors influence QID's performance, including the overall market sentiment, interest rate fluctuations, and the individual performance of the Nasdaq-100 companies.

- Investigating historical trends can provide valuable knowledge into QID's potential for both gains and risks.

- Traders should carefully consider their financial objectives before investing capital to QID or any other derivative ETF.

QID ETF Returns: Delving into the Risks and Rewards of Shorting the Nasdaq-100

The innovative QID ETF presents a provocative avenue for investors seeking to exploit market fluctuations by betting against the Nasdaq-100. Nevertheless, this tactic is not without its inherent risks. While the potential for significant returns is alluring, investors must thoroughly assess the nuances involved. Understanding the factors that impact QID ETF performance and employing robust risk mitigation strategies are essential for success in this unpredictable market terrain.

- Specifically, an unexpected rally in the Nasdaq-100 could lead to hefty losses for QID ETF holders.

- Furthermore, leveraged bets on short positions can intensify potential depletions if the market moves in a contrary direction.

Therefore, it is imperative for investors to carry out thorough due diligence and develop a well-defined investment approach that tackles the built-in risks associated with QID ETF investing.

Building a Portfolio Around QID: Leveraging Short Exposure for Strategic Diversification

Diversifying an investment portfolio is crucial for mitigating risk and maximizing returns. One increasingly popular approach involves incorporating short exposure through instruments like QID, which provides short-selling opportunities against volatility. By strategically allocating a portion of your assets to QID, you can boost the overall risk profile of an investment strategy, creating a more resilient and balanced approach.

- QID offers a unique way to offset downside risk, allowing investors to gain from market corrections while still participating in potential upswings.

- However, it's essential to understand the inherent risks associated with short selling, including unlimited downside.

- A well-structured portfolio should always consider investment goals and seek a balance between growth potential and risk management.

Regularly rebalancing your portfolio is key to maintaining the desired asset allocation and modifying your exposure to QID as market conditions evolve.

Understanding QID's Mechanics: A Guide to Leverage and Short ETFs

QID, a popular exchange-traded fund (ETF), provides investors with exposure to the inverse performance of the NASDAQ 100. Leveraging its structure, QID amplifies returns in both uptrends by utilizing derivatives. This means that when the underlying index declines, QID's value soars, and vice versa. Understanding this relationship is crucial for investors considering QID as part of their portfolio strategy.

Short ETFs like QID offer a unique avenue for hedging risk, allowing investors to profit from drawbacks in the market. However, it's essential to recognize that leveraging amplifies both gains and losses, making QID a unpredictable investment. Thorough research and careful consideration of your financial situation are paramount before diversifying in QID or any other leveraged ETF.

- Technical analysis of the underlying market index is crucial for gauging potential price movements that could affect QID's performance.

- Consider portfolio management across different asset classes to mitigate the concentrated risk associated with leveraged ETFs like QID.

- Track your investments regularly and adjust your portfolio as needed based on market conditions and your investment objectives.

Assessing QID's in Different Market Environments

Evaluating the efficacy of QID across diverse market situations is a significant undertaking. Analysts must carefully examine QID's outcomes under varying financial influences. This QID ETF returns involves determining how QID responds to fluctuations in demand, regulatory contexts, and competitive forces.

- Recognizing the strengths of QID in different market settings is fundamental for enhancing its impact.

- Additionally, it is necessary to assess QID's vulnerabilities in specific market situations to reduce potential challenges.

Scott Baio Then & Now!

Scott Baio Then & Now! Dylan and Cole Sprouse Then & Now!

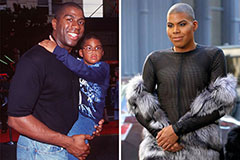

Dylan and Cole Sprouse Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!